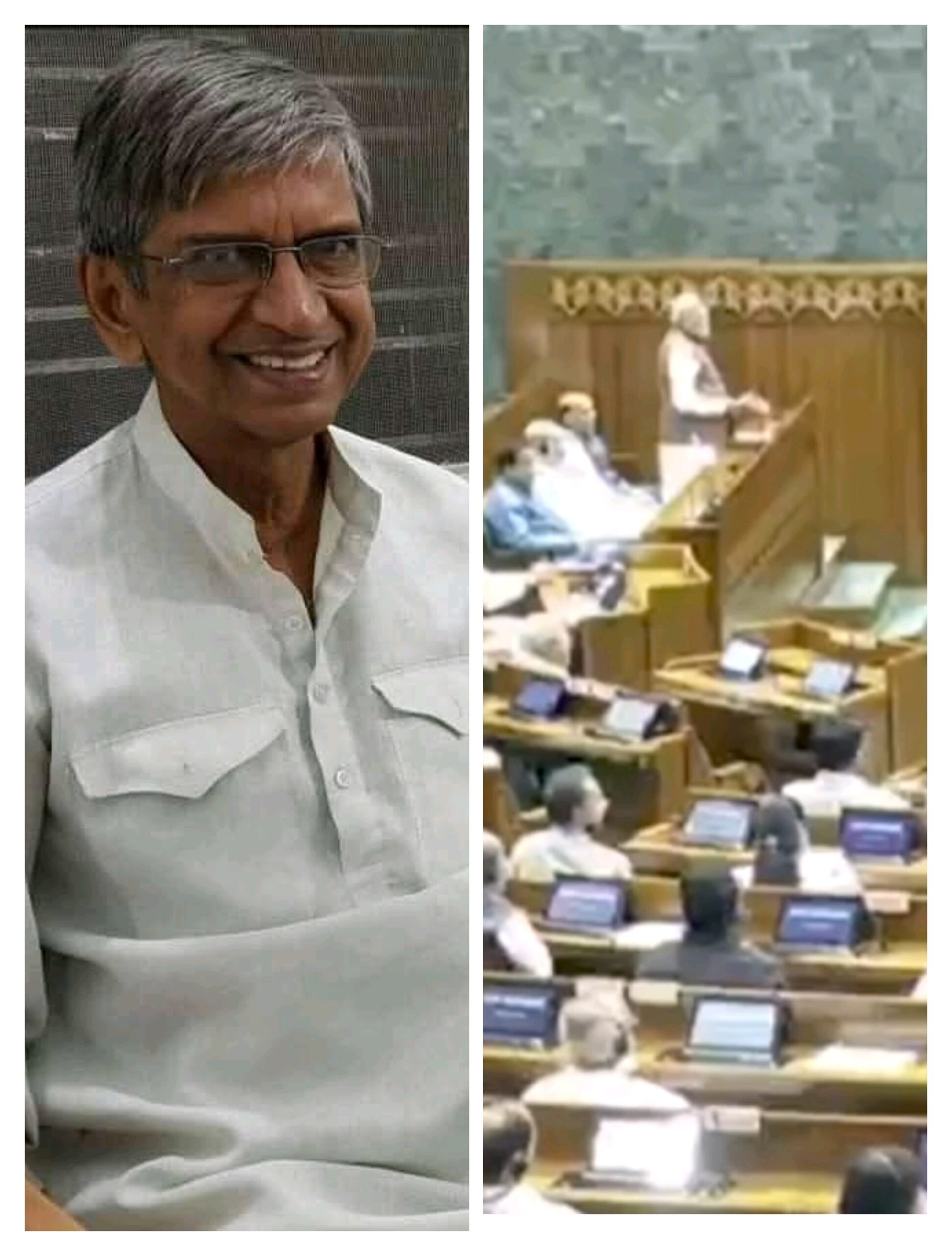

Stating that India is moving closer to become the world’s second largest steel producer, steel minister Chaudhary Birender Singh said on Tuesday that the target of more than doubling domestic steel-making capacity to 300 million tonnes (mt) by 2030-31, as envisaged in the New Steel Policy 2017, could be met smoothly. However, he cautioned that Indian steel companies need to have raw material linkages at affordable prices in order to become globally competitive. “It is important to have some degree of predictability in iron ore prices,” he said, adding that a committee set up by his ministry was working on this issue.

According to the minister, 2018 is going to be a landmark year for the Indian steel industry, as consolidation will be helped by non-performing asset (NPA) resolution. “This (consolidation) will lead to better capacity utilisation, synergy improvement and economies of scale,” he said.

“Our steel industry is highly dependent on coking coal imports. These imports stood at 41 mt in 2016-17, compared with 44 mt in 2015-16. While there was a 6.5 per cent decrease in the volume of imports, the value increased 45 per cent due to the high volatility in the global coking coal prices,” the minister said at a round table organised by FE, in association with the steel ministry. Singh also stressed that efforts were being made to reduce reliance on imported coking coal by producing more steel in the “BF-BOF (blast furnace-basic oxygen furnace) route”.

According to him, the ministry is carrying out a technical assessment of methanol production and coal gasification process to make integrated steel plants more lucrative. It has set up a task force to explore the feasibility of producing methanol from coal at Mozambique and India, replacement of natural gas by coal-gas in steel plants and carbon dioxide capturing to produce methanol.

India draws its competitiveness in steel from the vast availability of iron ore in the country, he noted. “We will need 437 mt of iron ore to grow the steel capacity to 300 mt by 2030-31,” the minister said.

Singh also said that since raw materials like iron ore and coal as also finished steel products are transported in bulk via rail, lowering freight and maximising availability of rakes could play a decisive role in increasing the steel industry’s competitiveness.

The steel ministry, he said, has formed a task force with representatives from the ministries of railways, urban development, road transport and highways and shipping to prepare a roadmap on increasing the use of steel in various infrastructure sectors. The bulk of infrastructure-related demand will come from government projects, he noted. While government-aided and government-initiated projects are on course, private sector investments also need to grow faster.

Steel secretary Aruna Sharma said that India’s current steelmaking capacity stands at 130 mt per annum and there was no reason why the capacity could not reach 300 mt by 2030-31. “The whole focus is now on enhancing the domestic demand. In India, steel is not cyclical. We are going to consume 90-95 per cent of the steel for the next 20-30 years,” she said.

Mines secretary Arun Kumar said that there is no paucity of iron ore in the country and more mines could be auctioned to meet future needs as well.

Seshagiri Rao, joint managing director and group CFO, JSW Steel, stressed the importance of raw material availability at competitive prices. Sunil Kakkar, executive vice-president and vertical head, supply chain, Maruti Suzuki India, said that its import reliance of steel has come down to 10 per cent from 30 per cent earlier, due to improved quality of steel available within the country.